Commercial property is an area of law where the stakes can be very high, with both landlord and tenant keen to protect their rights.

Whether you are agreeing a new commercial property contract or have a dispute with an existing contract, our team of commercial property law experts can assist.

We have extensive experience on all areas of commercial property legislation and we can help with contracts for business of all sizes. Whether you’re a sole trader setting up a workshop, or a national retailer seeking to expand, we can ensure that your contract processes smoothly and that nothing is missed.

For more information about our commercial property law services please call us on +44 (0)20 3475 6751 or email info@carterbond.co.uk

The Carter Bond Commercial Property Law Team specialises in the following services:

ACQUISITIONS & DISPOSALS

PROPERTY LITIGATION

AUCTIONS

CORPORATE REAL ESTATE

LANDLORD & TENANT DISPUTES

COMMERCIAL LANDLORD & TENANTS

LEASES

WHY CARTER BOND

Partner Led

Unlike many law firms when we say partner or barrister led, we mean partner or barrister led. When clients work with us, they get constant access to the lead on their instruction. Yes, we have a team of solicitors and juniors for some of the groundwork and necessary research required by our clients, but this is when it makes financial sense to the client for us to do this. We provide constant contact at no extra cost as part of our service as most of our lawyers have their own business, so they know first-hand how important having a proactive, responsible and trusted partner on their side can be. And also how to work to a financial budget, and the way that legal decisions impact the wider organisation, which often requires balancing risks and competing interests.

City quality, outer city fees

As the world changes, professionals in our society are realising that lifestyle is as vital to them as income. We are the lucky ones who have hand-picked lawyers who can provide the best quality advice but at outer City costs. Our offices are in North West London, which may not be in the City’s centre but at the same time this gives us two key advantages to set us apart:

- It allows us to charge our clients for what they pay for, our advice NOT our office space.

- Our staff save time and hassle on commutes which translates into a healthier working environment and more friendly and timely advice delivered to you.

ALL our lawyers have previously worked in large City-based law firms and continue to practise and offer the same high level of service they provided to clients in the City, but without the pressure and demands often dictated by City law firms. This allows us to be competitive on our fees without compromising our service.

We have made smart decisions about the way we operate, so you can trust us to help you make smart decisions about your matter.

All in all, our clients win, which is the way we like it.

Proactive contact

Many ask us ‘what’s different about you?’ and we like to reply, ‘because we go the extra mile’. We see our work as building and maintaining good business relationships rather than just earning fees. How we do this is by keeping in constant contact with our clients and intermediaries. From pre to post instruction we ensure that our clients are informed of all legal issues that may impact their business and therefore lives. That is why we provide daily or weekly updates to ALL of our clients whether there is anything to tell them or not (we don’t charge for this we just see it as part of our service). We like our clients to rest peacefully knowing that when we are instructed, and we say ‘we will take it from here’ they know we mean it.

Our knowledge and resources are yours

All our clients benefit from the same high level of care and attention whether the instruction is big or small. At the outset of each matter, we discuss the entire process with our clients, including the costs, potential outcomes and issues associated. This is to ensure clients are fully aware, knowledgeable and are in control always. Supporting and ensuring we provide the highest level of services, we offer our constant contact process with the partner or barrister leading your file, a document log in for matters which are for larger and more complicated instructions and on-going support post transaction should our clients require it. Our aim is not just to get the work done, but to make our clients’ lives easier as we do it, which is why we ensure that our clients have regular access to the resources they need from us.

YOUR COMMERCIAL LAW TEAM

Carley Ellis

Associate Solicitor, Commercial Property

e: carley@carterbond.co.uk

t: +44 020 3089 8470

Lena Thakrar

Partner, Commercial Property

e: lena@carterbond.co.uk

t: +44 020 3475 6751

m: +44 07939 033 890

Gaurav Anarkat

Solicitor, Commercial Property

e: gaurav@carterbond.co.uk

t: +44 020 3649 9008

Kunal Patel

Solicitor, Commercial Property

e: kunal@carterbond.co.uk

t: +44 020 3457 6751

Nikesh Shah

Partner, Corporate Commercial

e: nikesh@carterbond.co.uk

t: 02033360973

Ifath Khan

Partner, Commercial Property

e: ifath@carterbond.co.uk

t: 020 3089 8455

Mitin Bhalsod

Solicitor, Commercial Property

e: mitin@carterbond.co.uk

t: 020 3093 0870

MORE ABOUT COMMERCIAL PROPERTY LAW

Commercial property lawyers for tenants and landlords

Do you need help from a commercial property lawyer? Check out this legal guide to commercial property for advice and information you can trust.

Do you have commercial property and want to know more? Our team of commercial property lawyers have many years of experience and can help with all types of query. From auctions and acquisition to leases, litigation and landlord disputes, our expert commercial property lawyers can provide the advice and support you need.

Of course, we know that right now you might just be looking for information, or you may have a quick question. We’ve compiled this commercial property guide as a point of quick reference to common enquiries to make it easy to find the facts you can rely on.

What does a commercial property lawyer do?

Before deciding whether you need the services of a commercial property lawyer, you may find it helpful to learn more about how we can help.

Commercial property is a term used to cover a wide range of different types of buildings or land which are used for commercial purposes, or which generate profit for the owner. Types of commercial property include offices, retail units, garages, warehouses, industrial units, hotels, bars, restaurants, agricultural land, medical centres and some types of residential property when present in larger numbers.

A commercial property lawyer assists with a full spectrum of tasks associated with the above types of property including:

- Disputes and litigation between a commercial landlord and tenant

- Contract and lease negotiations including setting up, reviewing and termination

- Advise and assist both landlords and tenants

- Assist with recovery of commercial rent arrears

- Verify and investigate ownership and title

- Manage sales and purchases of commercial property (commercial conveyancing)

- Check suitability for intended commercial use

- Assisting with property investment and finance

- Prepare/check documentation for commercial property auctions

Commercial property lawyers have specialised knowledge which extends beyond property law, and into the more niche market of commercial transactions. These tend to higher value and more complex, which is why a commercial property lawyer is normally essential for all types of transaction.

Taking out a commercial lease - hints and tips

If you’re thinking of taking out a commercial lease, you may feel nervous at facing such a big step. However, if you approach the negotiations in a methodical and practical way you can ensure you eliminate as much risk as possible.

As you’re probably acutely aware, a commercial lease on a property has the potential to make or break your business so it’s important to get things right from the start. Carrying out your own contract negotiations without obtaining legal advice is often a false economy, as although you’ll save money now, you could end up facing significant unnecessary expenses at a later date. A commercial property lawyer can make sure that all loose ends are securely tied up, and there are no glaring gaps in the agreed terms.

You can reduce the expenditure by collecting information in advance. This will speed things up and also cut down the amount of work that your lawyer has to do. Some of the questions you might want to consider include:

- Is business use permitted under the terms of the lease? Also, does using the property for business breach the authorised use under the terms of the planning agreement? (Breaching agreed planning terms could result in enforcement activity against your business).

- Have you checked to see if the rights which are being granted to you are fit for your purposes?

- What is the condition of the property now? Your obligations as a tenant to keep the property maintained and decorated should be commensurate with the conditions the property was received in.

- Will there be a service charge? If so, will it be capped to a specified level every year?

- Is there a break clause included in the terms? It’s common for unfair restrictions to be added to a break clause, making it impossible to fulfil and therefore exercise. There should be the minimum possible conditions attached to any break clause. This is an area your commercial property lawyer will pay close attention to.

- Will you have the right to put up any signage? Without this, you may lose custom and not achieve your anticipated revenue.

- Will you be permitted to sublet the property or assign the lease?

- What rights will the landlord retain, and could this be detrimental to your business?

- Will you be able to fit out the property in the way you need?

- Is there a specified frequency for rent reviews? Every five years is often the standard but some landlords may push for earlier.

- Will stamp duty land tax be payable? The level of the rent will determine this.

- Is the lease plan compliant with Land Registry requirements? (Leases over seven years must be registered).

Your lawyer can advise on all of the above areas, and more, to ensure you don’t get saddled with a lease which has no means of exit and is unduly onerous.

Commercial rent arrears - available options

No matter how carefully you vet a tenant before leasing a property, circumstances may cause rent arrears to arise. There are various options for landlords to pursue but the best course of action depends on the outcome you hope to achieve.

We’ve listed here the main possibilities, together with the pros and cons of each:

Repayment Schedule

There’s nothing to stop the landlord and tenant just agreeing to a repayment schedule which is affordable and acceptable to both parties. No formalities are necessary but it’s highly advisable to get the agreement put in writing.

Pros:

- A simple solution which can be implemented rapidly

- Preserves a good relationship between landlord and tenant

- Provides tenant with the time to improve finances and could lead to full repayment

Cons:

- Many repayment schedules fail leaving the landlord forced to take alternative enforcement action anyway, thus delaying repayment

CRAR – Commercial Rent Arrears Recovery

CRAR is the mechanism which permits the landlord to seize goods belonging to the tenant which amount to the rent arrears debt. There are very strict procedures to follow and notice to the tenant must be given. Enforcement agents must be used to enact the recovery; the landlord is not permitted to seize the belongings himself.

Pros:

- Tenant can remain in the premises

- Relationship can be preserved if both sides agree

- Can be used against sub-tenants

- Effective when valuable goods are held onsite

Cons:

- Can only be used for rent debt, not service charges or other related unpaid costs

- Tenant will have the opportunity to remove their valuable items

Rent Deposit

If the landlord requested a deposit when the contract was signed, it may be possible to use this to cover the rent arrears. The wording on the lease agreement should be checked to see if this is permitted.

Pros:

- Provides a painless way for the landlord to receive their money

Cons:

- The tenant will have to top up the deposit

- The sum may not be sufficient to cover the full debt

- Only provides a temporary solution and doesn’t address any underlying difficulties

Pursue Guarantor

The landlord may be able to revert to the guarantor to recover the rent arrears plus associated debts. The precise procedure depends on the type of contract signed ie/whether it was an Authorised Guarantee Agreement.

Pros:

- The landlord receives their money, usually very quickly

- The tenant can remain in situ and the relationship can be preserved

- Is preferable when the tenant is suffering from financial difficulty

Cons:

- It’s possible the landlord may only be able to claim rent owing for the last six months

- In some cases, the guarantor can request an overriding lease

County Court Action

The landlord can attend court to issue proceedings which instruct the tenant to pay the rent and any other associated costs.

Pros:

- The proceedings may be slow which gives the tenant the time to improve finances

- The tenant can remain in situ and the relationship can continue if both sides are willing

- Negotiations can continue in the meantime

Cons:

- The slow speed means it could take a long time for the landlord to receive their money

- There is no guarantee payment will be made right away

Insolvency Proceedings

In the cases where the amount of the rent debt is not in dispute, a statutory demand can be issued. Depending on the value of the debt, it’s possible to issue insolvency proceedings if it remains unpaid after 21 days.

Pros:

- Issuing a statutory demand often produces rapid payment

Cons:

- Cannot be used where the amount of the arrears is being disputed

- Cannot be used for smaller sums

- If insolvency proceedings go ahead, the landlord may not get all of their money back

Forfeiture

A very final solution, forfeiture enables the landlord to end the lease to cover the cost of unpaid rent, plus any other debts. A quick and easy solution, forfeiture allows the landlord to simply to either reclaim the property by peaceful re-entry (in practice this means just changing the locks) or by going to court to issue proceedings to do this.

Pros:

- Threatening forfeiture can be sufficient to get a tenant to pay

- There are no complicated ends to tie up; the lease is terminated

- The landlord can move another tenant in right away

- It’s useful where there are other breaches along with rent arrears

Cons:

- May leave the property empty for some time if the landlord does not have a new tenant waiting

- The tenant can secure re-entry to the property via “relief from forfeiture”. This can only occur if they are able to remedy the breach (pay the outstanding debt/s).

- Will normally destroy the relationship which is a problem is the tenant obtains relief from forfeiture

Tenant checklist for activating a break clause

When you signed your commercial lease, you should have included a break clause. This is a way of cancelling the lease without being sued for breach of contract. Break clauses can either be mutual, which means the landlord can also activate it, or it may be solely for the benefit of the tenant.

The conditions of a break clause should be very carefully negotiated by a commercial property lawyer when the contract is being set up. This is because the court will interpret the terms very strictly and if you fail to meet the full definition, you could end up forfeiting your right to the break clause. Wherever possible, there should be no conditions attached to the break clause, other than all rate due being paid and a six month notice period given. If the landlord has any other issues with your tenancy – such as maintenance or decoration – they should be pursued outside the terms of the break clause. Including covenants within the break clause typically makes them impossible to fulfil.

If you’re now at the point of considering activating the break clause, make sure you have factored in all of the practical elements. Things to consider include:

- You cannot withdraw notification of a break clause without your landlord’s consent during the notice period so make sure you are certain first. If there is mutual agreement to revoke the notification, it will be considered as a new lease, with all the implications this brings.

- If there are any conditions that you are required to comply with for the break clause, keep evidence to show how you have met these in case of later dispute.

- If you have any concerns about complying with the conditions of the break clause, organise a compliance audit. Your commercial property lawyer can help you to organise this. This will highlight any potential breaches, and allow you to remedy them before you activate the break clause.

- Make sure you know exactly how much notice you are required to serve and that you meet this requirement. Even a small deviation will render the notification invalid and oblige you to continue with the lease.

- Notification must be in writing. You should keep proof of delivery of the notification and receipt to protect yourself.

- If you are using an agent to serve notice, make sure your landlord is aware that they are acting on your behalf, and that they have your consent to do so.

- Pay any outstanding debts to the landlord in full. If you are currently disputing the amount owing, it is advisable to pay the amount in full on a without prejudice basis. This enables you to continue to dispute the sum without invalidating your break clause. Non-payment of the full amount owing is an easy way for your landlord to have your break clause invalidated. There have been precedents set in the court to support this, so it’s essential that all payments which may be due are fully paid.

- When checking how much you owe, make sure there is no interest payable on any past arrears you may have accrued. Failing to pay the interest could allow the landlord to invalidate the break clause.

- Hopefully you won’t have any conditions to comply with to enable the break clause to be activated. Even if this is the case, it’s still advisable to ask the landlord to produce a schedule of dilapidations. This lists what the landlord believes is your responsibility to repair/replace under the terms of the original contract. If you are unfortunate enough to have covenants attached to your break clause, a schedule of dilapidations will be essential to allow you to identify what you need to do to fulfil the criteria to your landlord’s satisfaction. If covenants are attached that you don’t fulfil in time, the landlord can refuse to accept the break clause.

- Ensure any repairs or work being done on the property is completed by the break date. This includes removing your possessions to leave the property in the agreed state. If you do not provide vacant possession on the break date, it could invalidate the break clause and oblige you to continue paying rent until the expiry of the full contract.

As you can see from these criteria, activating a break clause is subject to some very specific obligations and responsibilities. Your commercial property lawyer can advise you on all of these, and help to ensure that you meet the full terms of the break clause.

Lease or license - The rights of a commercial tenant

If you are planning to let commercial property, you will have various options at your disposal. An unwritten agreement is one possibility, but it is rarely – if ever – advisable, even if the amounts involved are relatively low. It is still possible for obligations to arise which could become surprisingly costly which is why any agreement should always be in writing.

This leaves two further options: a lease or a licence.

A licence

A licence is only intended to cover short-term use, typically less than six months. It can often be seen as the simple option as it only provides permission to use a space, and does not imbue any legal rights, ownership or control. A licence is typically used for co-working spaces or for very short-term occupancy.

A lease

A lease is completely different to a licence, even though it can be used to create an agreement for use of the same type of space. Tenants have an interest in the property and a right to its exclusive use until the expiry of the lease.

Key features of a lease include:

- Certainty over the terms which will apply for the duration including who has responsibilities for areas such as repairs and maintenance

- Overall control for the landlord but certain rights for the tenant which are pre-agreed, such as subletting and assignment

- Coverage under the Landlord and Tenant Act 1954. This provides tenants with security of tenure, unless it is explicitly excluded.

- Provision of certain services by the landlord, and a guarantee that the tenant will be able to conduct their business without disruption

Providing the tenant continues to pay the rent and any service charges due, and doesn’t breach any of the conditions of the lease, they will hold the right to occupy it for the term specified. It is possible to include a break clause in the lease; this allows the contract to be ended early without penalty, if activated.

The difference

As can be seen very clearly from the descriptions above, a lease and a licence are two different arrangements, even though both could be created to allow use of the same space.

Caution must be exercised however, as it is possible to create a lease while intending to only create a licence. If the licence provides:

- Exclusive use of the property

- A fixed term (especially if longer than six months)

- Rent, and possibly a service charge

then in all probability, a lease has been created, not a licence.

This can cause problems, particularly over security of tenure as it allows the tenant to remain in the property and apply for a new contract upon expiry. With a licence, permission can be withdrawn at any time.

Commercial property lawyers often recommend creating a short-term lease rather than a licence. This is contracted out of the Landlord and Tenant Act 1954 so doesn’t provide security of tenure and in many cases is no more complex than agreeing a licence.

If you have a commercial property that you want to let out for a temporary period only, legal advice is essential to prevent accidentally providing your tenants with unintentional rights over use.

COMMERCIAL HIGHLIGHTS

Acted for a pension fund on the £55 million acquisition of 3 office buildings and headed up the team dealing with the subsequent estate management

We have completed over 700 lease grants and assignments for both landlords and tenants

Advised on the loan of a £270 million to finance the development of one of the tallest skyscrapers at the time in the City of London

KIND WORDS

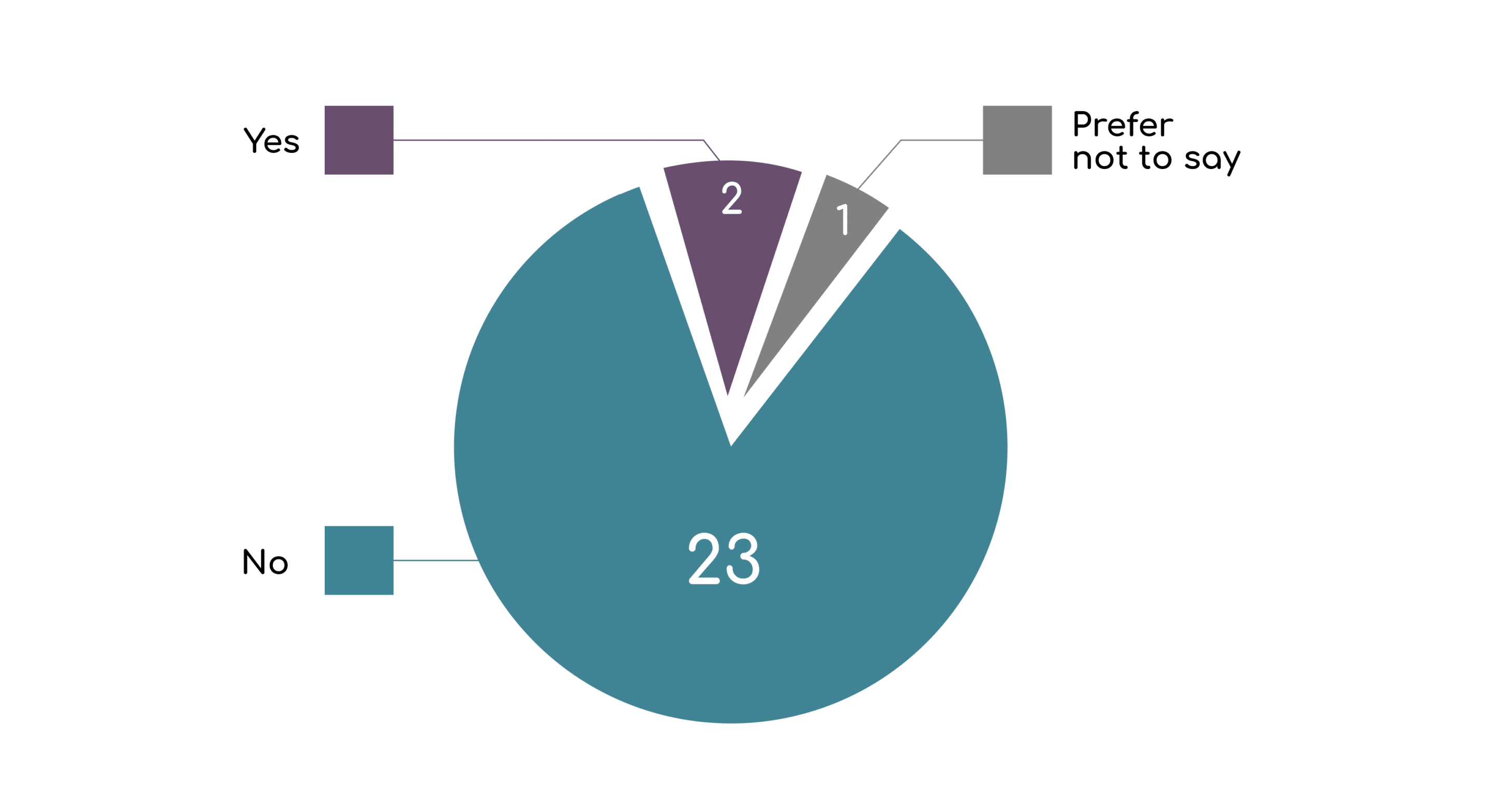

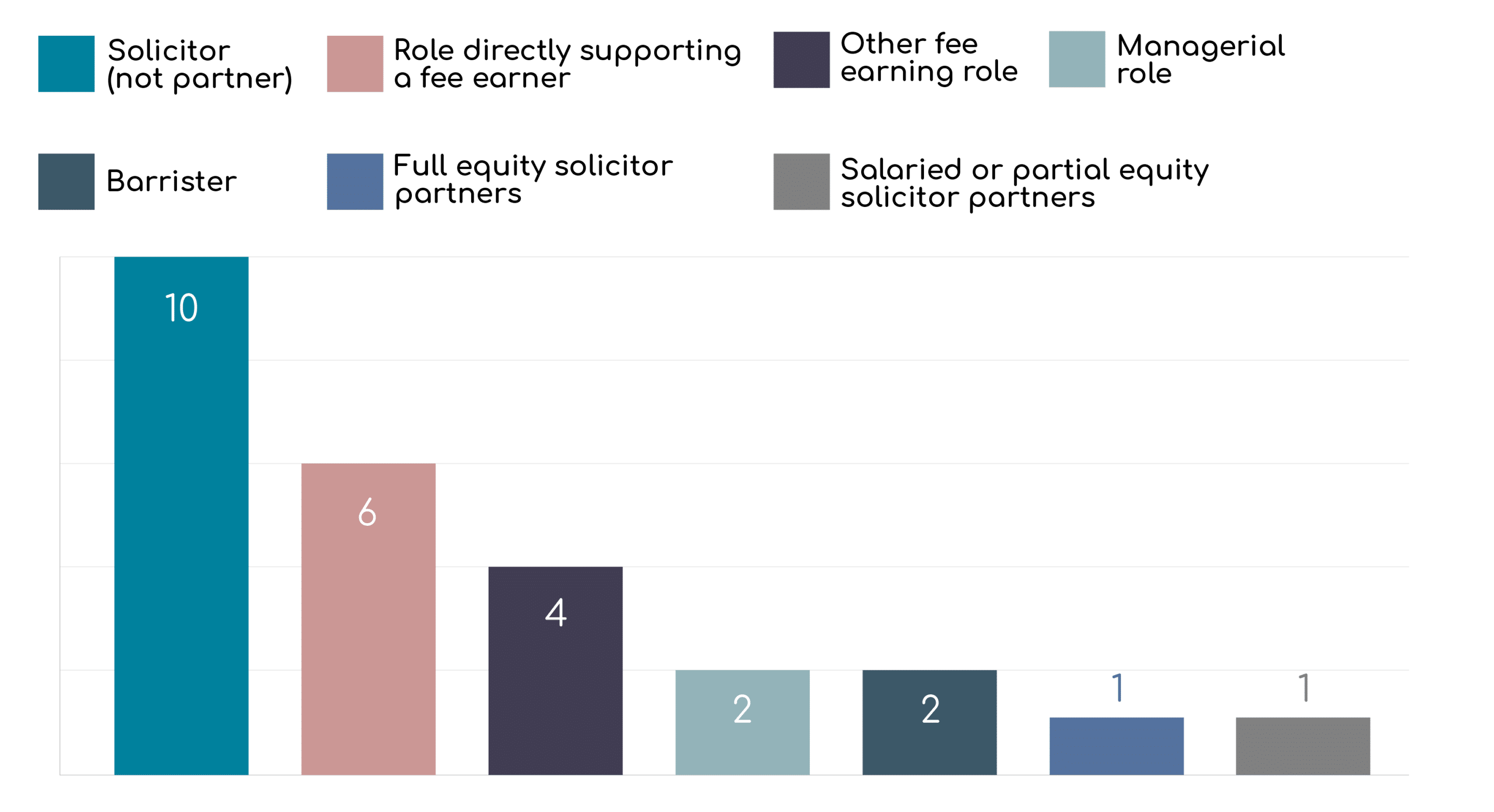

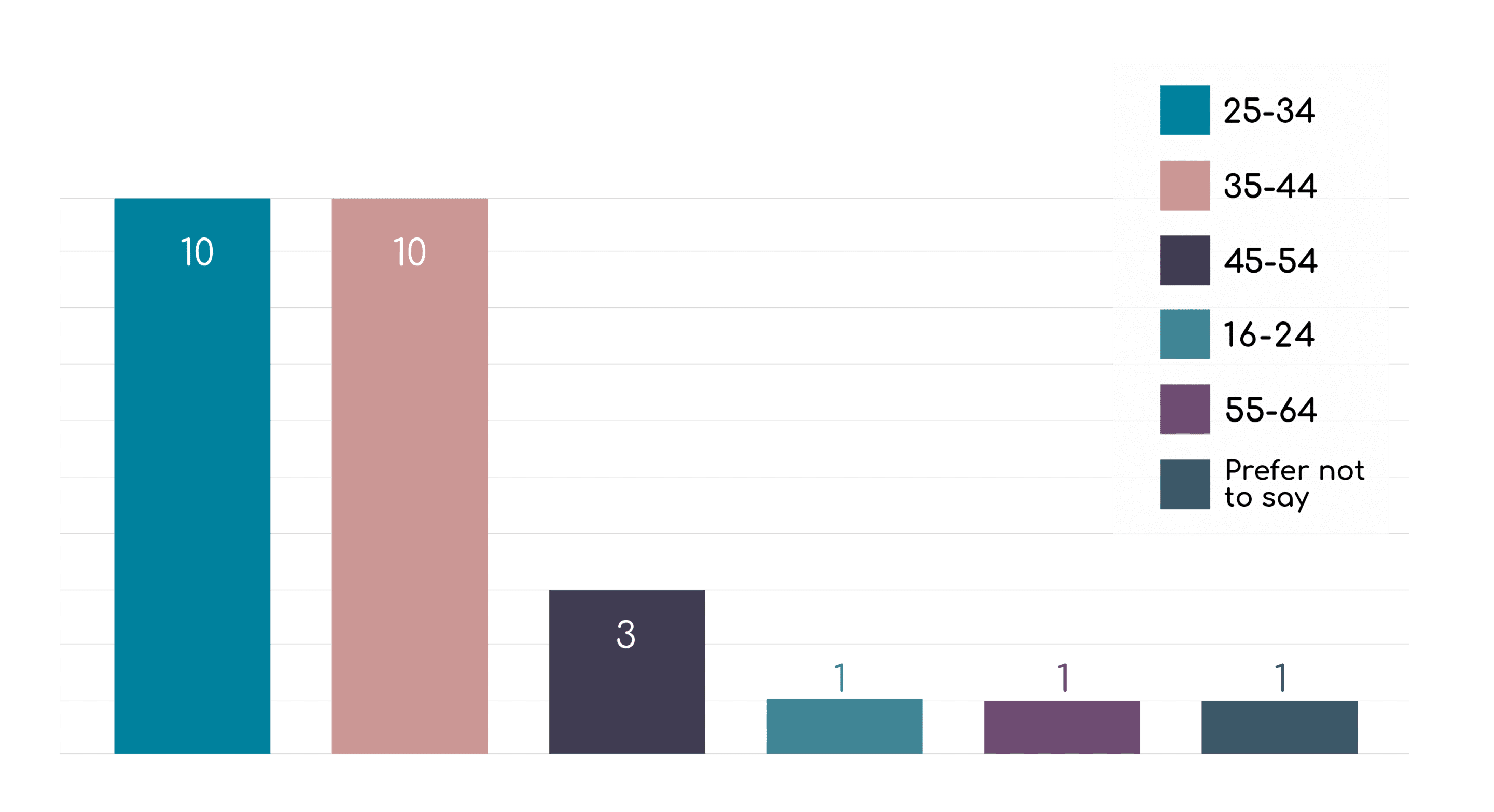

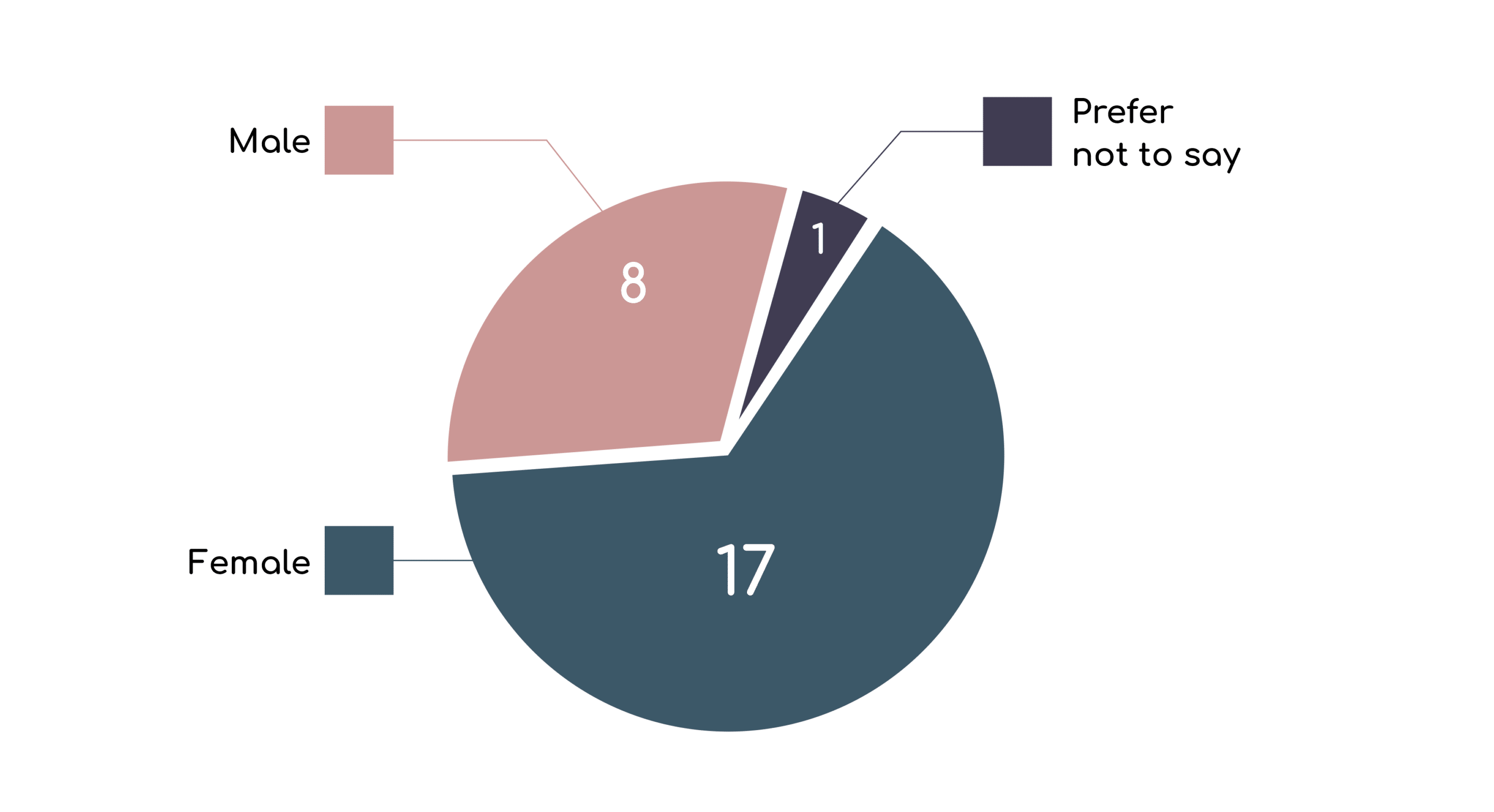

DIVERSITY AT CARTER BOND

Professional Role

Age

Gender