INSIGHT

Covid-19

Supporting businesses and individuals who seek quality advice and support from their legal and professional advisers in relation to Coronavirus.

We will be collating and categorising all of the essential information your business needs during these challenging times.

Despite the unprecedented challenges, it remains critical for directors and management teams to be proactive and plan to mitigate the risks to their staff, business and stakeholders. We have provided insight on the key legal and business issues as a result of Covid-19 and will be updating this guidance as the situation develops.

For more information about how the pandemic may affect you or your business please call us on +44 (0)20 3475 6751 or email info@carterbond.co.uk

How we are dealing with the Covid-19 situation

As COVID-19 continues to spread, Carter Bond Solicitors continues to closely monitor and act upon the information released by the HM Government and the World Health Organization. We have also already taken a number of measures to mitigate against any threats presented by the evolving situation.

As our top priority is the health and safety of our colleagues, we are communicating regularly with them in an effort to safeguard their health and safety whilst mitigating any risk to the delivery of our services to clients.

Business continuity is a key priority at Carter Bond Solicitors and we have already heavily invested in secure, robust systems that support working from home, and most employees have already utilised this infrastructure regularly. This investment, along with our strong team culture, enables us to protect our colleagues by implementing a work from home policy which has been in place since March.

All of us at Carter Bond Solicitors are ready and available to support our clients to ensure the continuity of their business.

Clients can, therefore, be assured that we are resolved to continuing to progress their legal matters in the same manner as before.

Our lawyers are available on telephone and email, as usual. You can also email us at info@carterbond.co.uk and, as clear communication is extremely important at times like this, we will continue to communicate as appropriate as the situation evolves.

How the government are supporting businesses during this period

In its daily briefings, the government has been announcing the rollout of several significant measures designed to mitigate the financial impact of COVID-19 on businesses. Particular attention has been paid to those sectors most affected by the spread of the virus, the hospitality and travel sector.

The situation changes daily with new measures introduced on a rolling basis. A brief overview of the current level of support includes:

- Guarantees to pay 80% of wages for employees unable to work up to £2,500

- Deferment of VAT and income tax payments to the next quarter

- Statutory sick pay relief for small business

- 12-month business rates holiday for companies in the most affected sectors

- Grant funding of £10,000 for business eligible for small business rate relief or rural rate relief

- Grant funding of £25,000 for retail, hospitality and leisure business

- Loan guarantees worth up to £330 billion through the Coronavirus Business Interruption Loan Scheme and COVID-19 Corporate Financing Facility

Last updated: May 2020

To keep up to date with government’s measures to support businesses, go to the dedicated COVID-19 business support guidance publication with updates on the schemes available and how to apply: https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19

Covid-19 & employment

As an employer it is an employer’s duty to protect the health, safety and welfare of their employees and other people who might be affected by their business.

In line with the government guidelines, employers are expected to act in the best interests of their staff. In recent weeks, a huge section of the UK workforce has been confined to working from home, bringing with it issues around remote working that many businesses have never had to deal with before.

Absence from work for sickness is another challenge for businesses. While the government has provided statutory sick pay relief for small businesses, there are many other possible legal implications from changed working circumstances.

Already many businesses have let staff go, have sought to reduce wages or placed staff on unpaid leave where possible.

As the area of employment law is broad, we cover HR and employment law issues in a separate article, which you can access here.

Covid-19 & Tax

What the government is doing about tax

One of the first measures introduced by the government was a commitment to offer more lenient terms of payments due to HMRC. While other costs can be cut, the sudden disruption has left many businesses worried about dipping into their reserves put aside for VAT and corporation tax.

Most recently, the government announced the deferment of company’s VAT liability to June 2020, providing businesses with short term cash reserves.

HMRC launched a new helpline number for business owners to discuss tax liabilities and other problems arising from COVID-19. This helpline is in addition to the HMRC’s Time To Pay Scheme.

HMRC stated it would look at each situation on a case-by-case basis, with particular support for the sectors most affected, such as travel and tourism. Beyond that you can discuss a range of options HMRC may be able to offer, including:

- Deferring payments

- Suspending debt collection proceedings

- Cancelling late payment penalties

- Cancelling interest on late payments

Covid-19 & Contracts

How COVID-19 may affect existing contracts with customers/clients and suppliers

There has been much discussion around the status of contractual rights during this period. Due to government advice, many events have been cancelled, which have an impact on both the organisers and those who have paid to attend, exhibit or participate. These cancellations may leave both parties with costs – some of which may be covered by cancellation fees.

Many of these contractual discussions are focus on the “force majeure” clause and whether COVID-19 falls into this category. This also has an impact on the ability to claim for insurance, as part of business interruption.

Additionally, as a result of the sudden drop-off in sales, many businesses are looking to cut costs rapidly. This may mean ending ongoing or retained contracts earlier or changing the terms or timing of existing contracts to reflect the new situation. Whether you are looking to make contractual changes or are subject to clients/customers looking to make changes, it is advisable to consult with a contract law specialist.

We cover contract issues arising from COVID-19 in a separate article which you can read here >

For any issues relating to contracts or litigation, Carter Bond can support you. Call our team on 020 3475 6751 and we’ll be happy to assist

MORE COVID 19 INSIGHTS

COVID-19 and Employment Law

One of the biggest issues around the Coronavirus outbreak has been the need to "self-isolate" and dramatically reduce opportunities for COVID-19 to spread. This move to self-isolation has resulted in an estimated 20% of the UK workforce working from home. This...

Where do you go for advice? Everyone’s the expert!

The UK Government has provided further details of the Coronavirus Job Retention Scheme to help employers avoid redundancies during the Co-Vid pandemic. We have summarised the key features below. Scope of the Scheme The Scheme is open to all UK employers, who operated...

DIVERSITY AT CARTER BOND

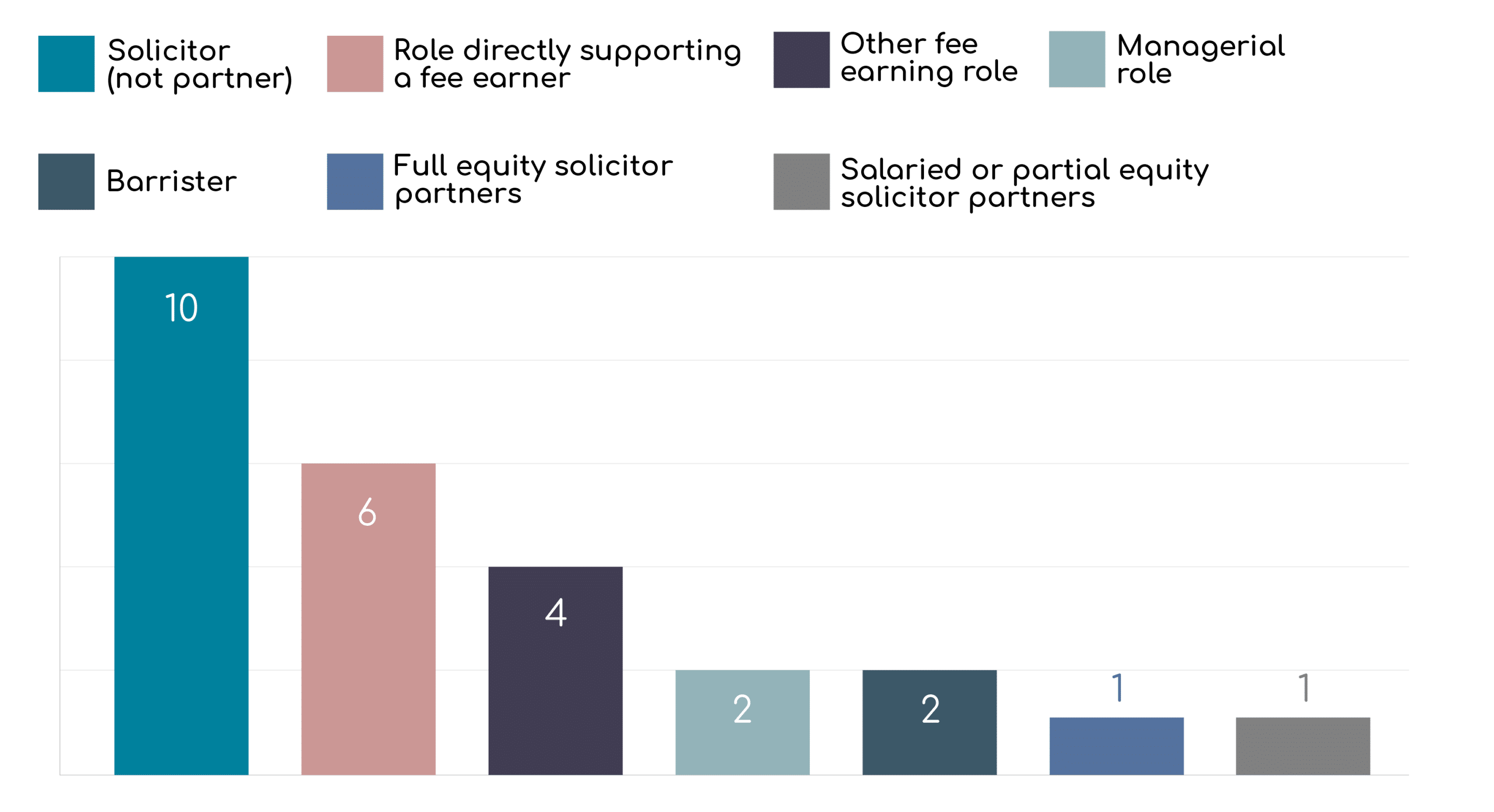

Professional Role

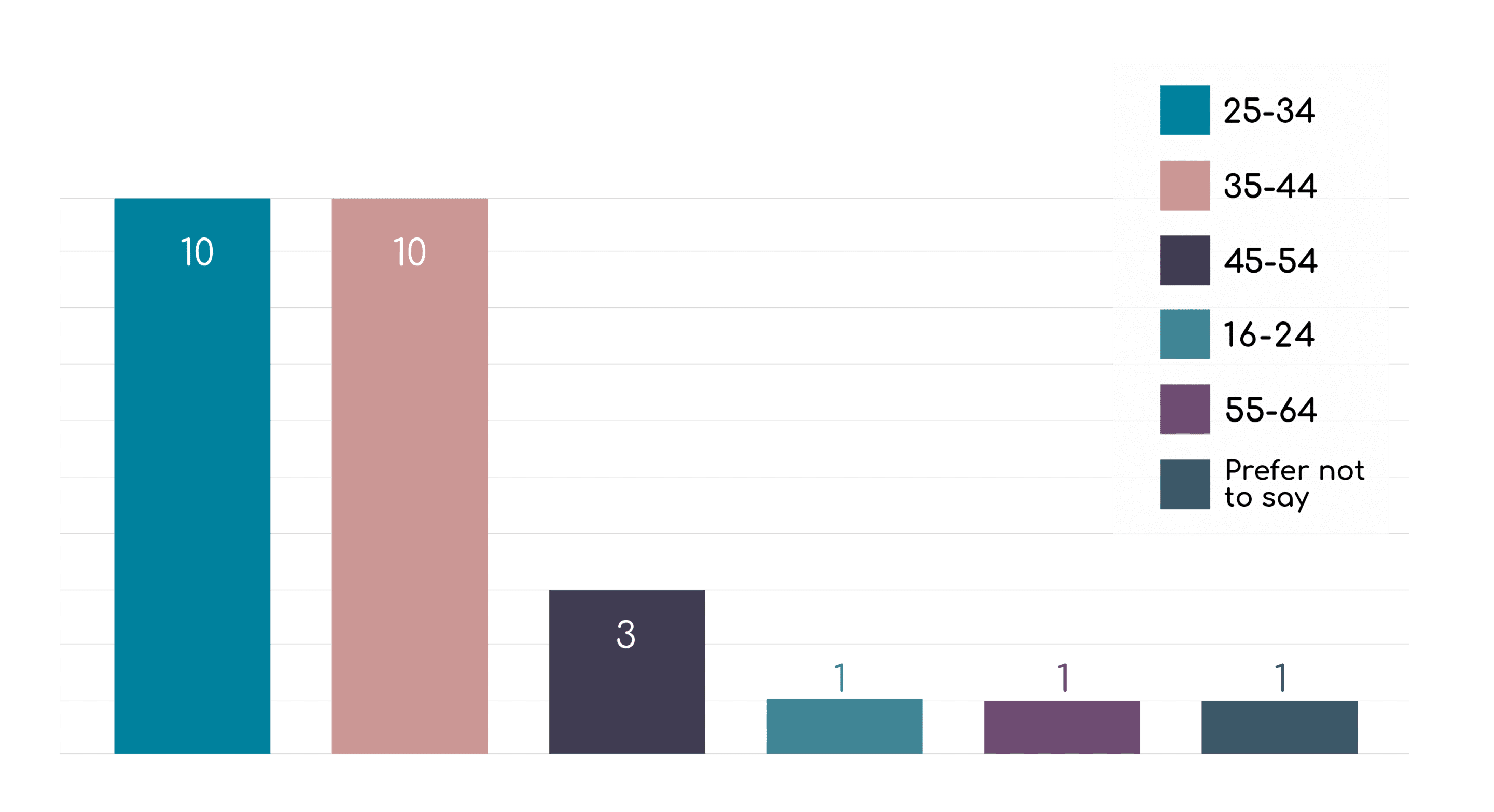

Age

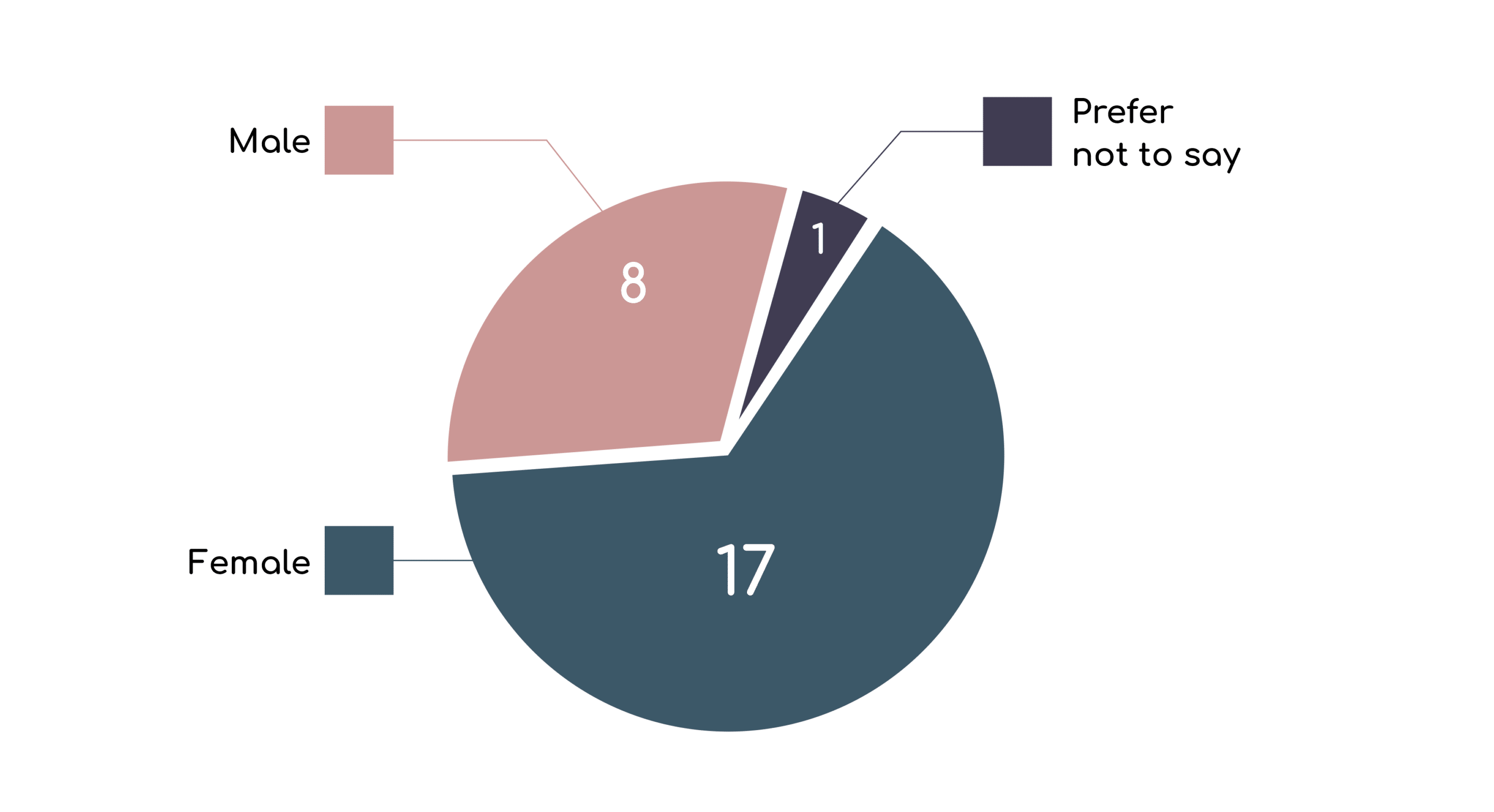

Gender